Check CPP Payments ($1,600 Bonus) Eligibility For January 29

The Canada Pension Plan (CPP) payment dates for January 2025 will be distributed on January 29, 2025. This will be the first CPP payment of the year. The good news is that this payment will contain regular CPP payments and an additional CPP bonus of $1,600 for eligible individuals.

CPP Next Payment January 29, 2025

The next Canada Pension Plan (CPP) payment dates will be on January 29, 2025. These payments will include two different payments for eligible individuals.

Key Details for January 29, 2025 CPP Payments

Here are the key details for the upcoming January 29, 2025 CPP payments, including a bonus payment of $1,600:

Detail | Information |

|---|---|

Payment Date | January 29, 2025 |

Bonus Amount | $1,600 (one-time payment) |

Eligibility Criteria | Canadians aged 60–70, valid CPP contributions, and Canadian residency |

Automatic Payment | Yes, no application required; funds will be deposited directly into accounts |

Purpose of Bonus | To provide financial relief amidst rising living costs |

Payment Mode | Direct deposit or paper checks (if no direct deposit is set up) |

Estimated Deposit Time | 1–2 weeks for direct deposit; 3–4 weeks for paper checks |

Make sure to check your eligibility and stay informed to ensure timely receipt of your CPP payment and bonus amount of $1,600.

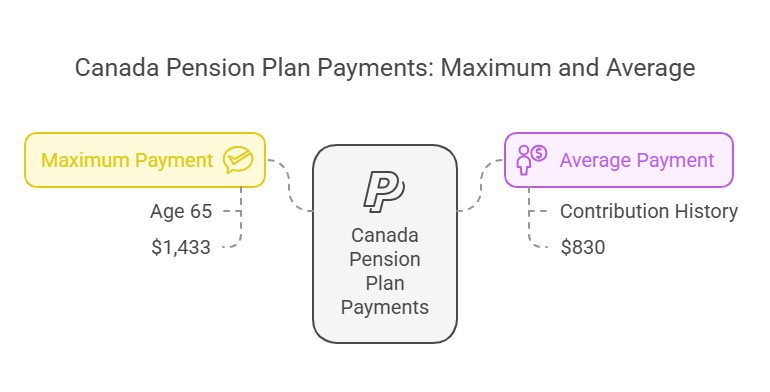

Payment Amounts

As of January 29, 2025, there will be two different CPP payments. Here are the details for both payments:

1. Regular CPP payment

The payment amounts depend upon several factors. These factors include contribution history and the age at which you start receiving your benefits.

If you start receiving CPP at age 65, you get the standard amount. Starting earlier (as early as age 60) causes a reduction in the amount of the benefit. While on the other hand, delaying them (up to age 70) increases them.

In 2025;

Also Check related article: CPP Enhancements 2025 | A New Era for Contributions

An Example of Regular Payment

In 2025, if Sarah starts CPP at 65, she will get $1,433/month. Starting early at 60 reduces it by 36%:

1433×(1−0.36)=917$

So, she gets $917/month. Delaying to 70 increases it by 42%:

1433×(1+0.42)=2035$

She would then get $2,035/month.

You can also use CPP payment amount calculator to determine your CPP amounts.

2. CPP Extra Bonus

In addition to regular payment, a $1,600 bonus on January 29 will be given to the eligible individuals. This is a lump-sum payment provided automatically to qualified Canadians. The reason for this bonus is to provide financial aid against the rising living expenses.

Keep in mind that, it is only a time payment. It will be provided only once with the first CPP payment. Here is a practical example that helps you understand.

The $1,600 CPP bonus on January 29, 2025, is for Canadians aged 60-70 who contributed to CPP during their working years and currently reside in Canada. Payments are automatic for eligible recipients and taxable. Ensure your banking details are updated in your My Service Canada Account.

An Example of Extra Bonus

If Sarah started CPP early and receives $917 per month, adding the $1,600 bonus on January 29, 2025, her total payment for the month will be:

917+1600=2517$

So, she will receive $2,517 in total.

The amount of the bonus on January 29 will be $1,600. This amount is announced by official resources like the Canada Revenue Agency.

How Will You Receive Your Payment?

Payments will be made through direct deposit into your bank account or via mailed cheques. If you are not enrolled in the direct deposit, your payments will be issued through mailed cheques. To ensure you receive your payment without delays:

If you do not receive your payments on the scheduled date ( January 29, 2025), wait for five working days before contacting CRA.

Eligibility for Regular and CPP Bonus Payment

The CPP regular payments and CPP bonus have their specific eligibilities. Here are the details for both:

1. Eligibility For Regular Payments

To qualify for regular Canada Pension Plan (CPP) payments:

If you fulfill the above criteria, you will be qualified for the CPP regular payments. You can get maximum payments if you fall into maximum payment category of CPP.

2. $1,600 Bonus Payment Eligibility

For the one-time $1,600 bonus payment on January 29, 2025:

To qualify for bonus credits, it is necessary to fulfill both regular eligibility criteria as well as bonus criteria.

Tax Implications

Keep in mind that Both regular CPP payments and the $1,600 bonus are considered taxable income. This means you’ll need to report them when filing your taxes for 2025. The tax filing for CPP benefits is mandatory. Plan accordingly to avoid surprises during tax season. File your taxes on time to avoid penalties and financial issues.

Canada Pension Plan Upcoming Payments

The upcoming CPP payments dates are as follows:

| Payment Number | Date |

|---|---|

| First payment | January 29, 2025 (Wednesday) |

| Second payment | February 26, 2025 (Wednesday) |

| Third payment | March 27, 2025 (Thursday) |

| Fourth payment | April 28, 2025 (Monday) |

| Fifth payment | May 28, 2025 (Wednesday) |

| Sixth payment | June 26, 2025 (Thursday) |

| Seventh payment | July 29, 2025 (Tuesday) |

| Eighth payment | August 27, 2025 (Wednesday) |

| Ninth payment | September 25, 2025 (Thursday) |

| Tenth payment | October 29, 2025 (Wednesday) |

| Eleventh payment | November 26, 2025 (Wednesday) |

| Twelfth payment | December 22, 2025 (Monday) |

Keep an eye on the payment calendar to receive timely payments.

How To Maximize Your CPP Benefits

Here are some practical tips that help you to maximize your benefits:

Follow the above-provided precautions to get maximum benefits. In my experience, this will help you receive the majority of your payments and provide the best financial aid.

Conclusion

The upcoming CPP payments on January 29, 2025, offer significant financial relief to Canadians with regular monthly benefits and a $1,600 one-time bonus. This initiative aims to enhance financial stability during economic challenges. By staying informed and ensuring your details are updated with Service Canada, you can maximize these benefits for daily expenses and future savings.