Canada Pension Plan (CPP) at 60 vs 65 | New Policy 2025

The CPP is a government financial program that provides retirement benefits to Canadians who have contributed to it during their working years. Deciding when to start your Canada Pension Plan (CPP) payments is a big decision. Here we have provided detailed information about CPP at 60 VS 65. The CPP calculator will help you to check the benefits at 60 and 65.

Canada Pension Plan At 60 Versus 65 Overview

Here is a quick overview of CPP maximum benefits at 60 VS 65.

Factor | Age 60 | Age 65 |

|---|---|---|

Monthly Payment | Reduced by up to 36% | Full payment |

Total Lifetime Payout | More years but smaller amounts | Fewer years but larger amounts |

Best For | Immediate financial needs or shorter life expectancy | Maximizing long-term benefits |

In the end, deciding to take your Canada Pension Plan at 60 or 65 depends on your money needs, health, and retirement plans. Choose what feels right for your future

Also Check related article: Maximum CPP (Contribution) Payment

Canada Pension Plan At 60

Here are the details about the maximum Canada Pension at the age of 60:

If you start receiving your CPP payments at 60, your monthly payment is reduced by 0.6% every month. This reduction will be implemented before your 65th birthday. In this way, it causes a total permanent reduction of 36% in Canada pension plan benefits.

Also Check related article: CPP Enhancements 2025 | A New Era for Contributions

An Example of CPP payments at 60:

If you are eligible for $1,000 per month at age 65 but start CPP at age 60, your payment is reduced by 0.6% per month for 60 months (5 years).

That’s a total reduction of: 0.6% × 60 = 36%

Full payment at 65: $1,000

Reduction (36%): $1,000 × 36% = $360

New payment at 60: $1,000 − $360 = $640 per month

So, starting CPP at 60 means you’ll receive $640 per month, permanently reduced by 36%. The early start of CPP payments causes a reduction in the benefits amounts.

Also Check related Post : CPP Death Benefit: Apply & Eligibility in 2025

Pros And Corns Of CPP at 60

Taking CPP at age 60 has advantages as well as disadvantages. Here is the detailed information on advantages and disadvantages at 60:

Pros at 60:

Cons at 60:

Here are the corns about it:

It’s a good idea to get CPP at 60 if you need the money early or have health issues. However, waiting until 65 may be better for maximizing long-term benefits.

CPP Payments at Age 65

65 is the standard time to start CPP payments. At this age, you’ll receive your maximum Canada Pension Plan Benefits.

At the age of 65, You get the full monthly amount without any penalties.

An Example of CPP payments at 65:

If you are eligible for $1,000 per month in CPP benefits, and you start receiving payments at age 65, there are no reductions or penalties. You’ll receive the full amount of $1,000 every month.

Monthly payment at 65: $1,000

Annual payment: $1,000 × 12 months = $12,000 per year

If you live for 20 years after age 65 (until age 85), your total CPP payments would be:

$1,000 × 12 months × 20 years = $240,000

This shows that starting at 65 age gives you the full benefit with no reductions. Due to no reductions and penalties, it is a better idea to start your CPP at the age of 65.

Pros And Cons Of Starting CPP at 65

Starting your CPP benefits at the age of 65 has some advantages and disadvantages. Here is a detailed piece of information about CPP at the age of 65.

Pros at 65:

Here are the details about the advantages of CPP at 65.

Cons at 65:

Here are the disadvantages of the Canada Pension Plan at 65:

Taking CPP at 65 is best for those who can wait and want the full benefit for long-term financial security!

What Happens If You Delay Beyond Age 65?

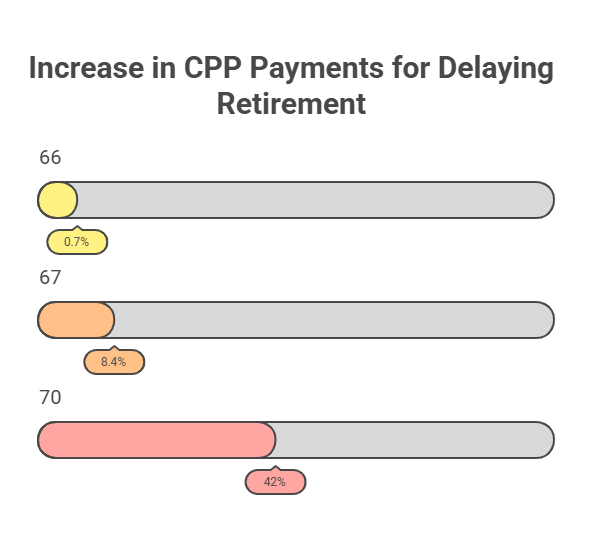

You can delay taking CPP until as late as age 70. For every month after your 65th birthday that you delay, your payment increases by 0.7%, or 8.4% per year, up to a maximum of an additional 42% at age 70.

For example:

A $1,000 monthly payment at age 65 would grow to $1,420 per month if delayed until age 70.

It is a good idea to delay your pension until 70 if:

How to Decide?

The right choice depends on your situation. Here are some points that would help you to decide the right time for CPP benefits:

The right choice depends on your situation. Here are some points that would help you to decide the right time for CPP benefits:

Conclusion

Choosing the age of receiving your Canada Pension Plan benefits is a personal choice that depends upon various factors. Starting early provides immediate income but reduces lifetime benefits. On the other hand, waiting ensures higher monthly payments.

However, choosing the Canada Pension Plan at the age of 60 VS 65 with the help of a financial advisor is a good idea.