Ontario Trillium Benefit (OTB) Payment Dates 2025

The Ontario Trillium Benefit (OTB) provides financial assistance to Ontario residents. The CRA has officially announced the Ontario Trillium Benefit payment dates (OTB) for 2025. OTB payments are for Ontario residents, while Federal-Provincial-Territorial (FPT) payments assist all Canadian households. The CRA has announced additional guidelines for 2025, including payment amounts and eligibility.

Ontario Trillium Benefit Payment Dates

The OTB payment date falls on the 10th of every month. Here is the OTB payment schedule for 2025.

Month | Payment Date |

|---|---|

January | January 10, 2025 |

February | February 10, 2025 |

March | March 10, 2025 |

April | April 10, 2025 |

May | May 9, 2025 |

June | June 10, 2025 |

July | July 10, 2025 |

August | August 8, 2025 |

September | September 10, 2025 |

October | October 10, 2025 |

November | November 10, 2025 |

December | December 10, 2025 |

OTB payments are scheduled for the 10th of each month. If the payment date falls on a holiday, it will be moved to the last business day before the scheduled date.

Ontario Trillium Overview

Below is an overview of the Ontario Trillium Benefit (OTB):

Aspect | Details |

|---|---|

Name | Ontario Trillium Benefit (OTB) |

Administered By | Canada Revenue Agency (CRA) on behalf of the Province of Ontario |

Start Date | Introduced through Ontario Regulation 468/11 under the Taxation Act, 2007, effective December 2011 |

Purpose | Provides financial relief for energy costs, property taxes, and sales taxes. |

Components | OEPTC, NOEC, OSTC |

The Ontario Trillium Benefit (OTB) was launched to provide financial assistance to Ontario residents and their families. OTB conveniently combines three credits into a single payment. The three credits are:

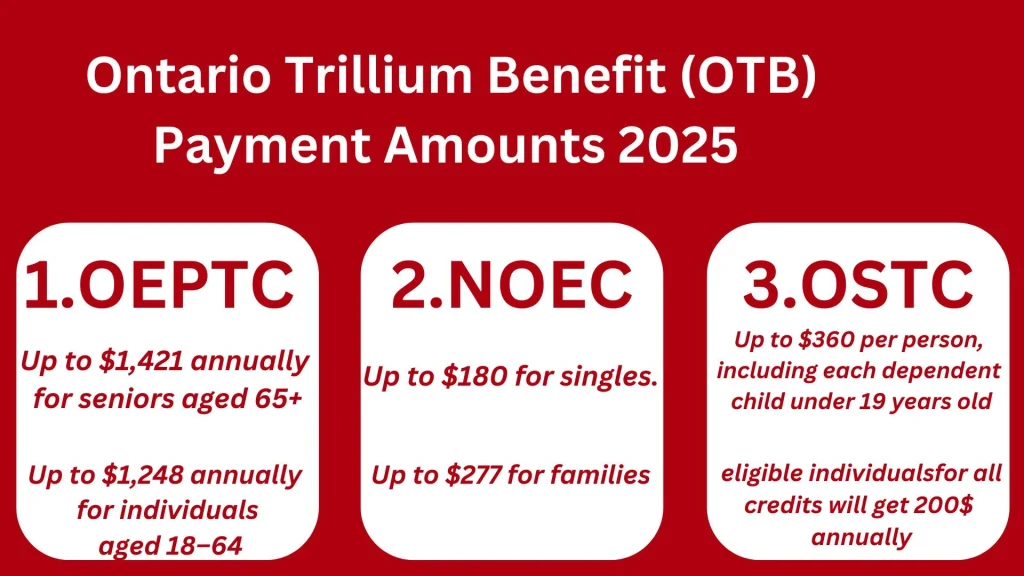

Trillium Benefit Payment Amounts

The benefit amount is calculated based on several factors. The OTB amount depends on income, age, family size, location, and living expenses such as rent or property taxes.

According to the Canada Revenue Agency (CRA), as of 2025, the maximum annual Ontario Trillium Benefit (OTB) payment amounts are as follows :

Ontario Energy and Property Tax Credit (OEPTC):

Northern Ontario Energy Credit (NOEC):

Ontario Sales Tax Credit (OSTC):

Individuals eligible for all credits will receive at least $200 annually.

Example

Here is an example to help you understand how payment amounts are determined.

Sarah, an Ontario resident with a modest income, qualifies for all three credits. She receives $1,200 from the Ontario Energy and Property Tax Credit, $150 from the Northern Ontario Energy Credit, and $300 from the Ontario Sales Tax Credit. In total, Sarah gets $1,650 annually to help with her living expenses.

Contact CRA

In the following situations, contact the CRA for assistance.

Tips to Maximize Your OTB Payments

By following these tips, you can make sure you get the full amount of your payments.

Trillium Benefits Payment Methods

The two methods to receive OTB payments are as follows:

1. Direct Deposit

With direct deposit, payments are sent directly to your bank account. The direct deposit method is the latest, fastest, and most secure. This is why it is popular and recommended by the CRA.

You can set up direct deposit by:

Why Choose Direct Deposit

Here are a few reasons to choose direct deposit over cheque payments.

2. Mail Cheque

In mail payment methods, the cheques are mailed to the registered mailing address. The cheques are mailed on the 10th of each month. Cheque payments are slower and carry some risks.

Ontario Trillium Benefits Eligibility

The eligibility criteria for OTB are as follows:

It is necessary to meet these requirements; otherwise, you will not be eligible for the Ontario Trillium Benefit.

How to Apply for the Ontario Trillium Benefit

You do not need to apply separately for the Ontario Trillium Benefit. Just file your personal income tax return on time, and the CRA will automatically determine your eligibility. File your tax returns on time even if you are unable to pay taxes.

Ontario Trillium Benefit Helpline

The OTB contact details are provided below. You can contact the helpline if you have any issues.

Feel free to reach out to any of these numbers for assistance with your Ontario Trillium Benefit.

FAQs

Conclusion

The Ontario Trillium Benefit provides essential financial support to help Ontarians cover rising costs like energy bills and property taxes. It is important to understand the Ontario Trillium Benefit payment dates, eligibility, and payment amounts.

All details about OTB are provided above. If you still have any issues, feel free to visit the OTB website or contact the CRA at 1-800-959-8281.