OAS Payment Dates 2025 in Canada [Official Dates]

Old Age Security is one of the essential financial support to the senior citizens of Canada. It is a part of Canada FPT payments. The Canada Revenue Agency has officially announced the OAS payment dates for 2025. In 2025, the Old Age Security payments are normally made on the third to last working days of every month. Below is the in-depth guidance about the payment schedule, OAS application, eligibility, and payment methods.

OAS Payment Dates

The Canada Revenue Agency has officially launched the payment dates for 2025. Keep an eye on the payment schedule and stay tuned for your next payment. THE OAS payment calendar is as follows.

Payment Name | Payment Date |

|---|---|

First Payment (January) | January 29, 2025 |

Second Payment (February) | February 26, 2025 |

Third Payment (March) | March 27, 2025 |

Fourth Payment (April) | April 28, 2025 |

Fifth Payment (May) | May 28, 2025 |

Sixth Payment (June) | June 26, 2025 |

Seventh Payment (July) | July 29, 2025 |

Eighth Payment (August) | August 27, 2025 |

Ninth Payment (September) | September 25, 2025 |

Tenth Payment (October) | October 29, 2025 |

Eleventh Payment (November) | November 26, 2025 |

Twelfth Payment (December) | December 22, 2025 |

Keep track of these OAS payment dates to ensure you receive your benefits on time throughout 2025.

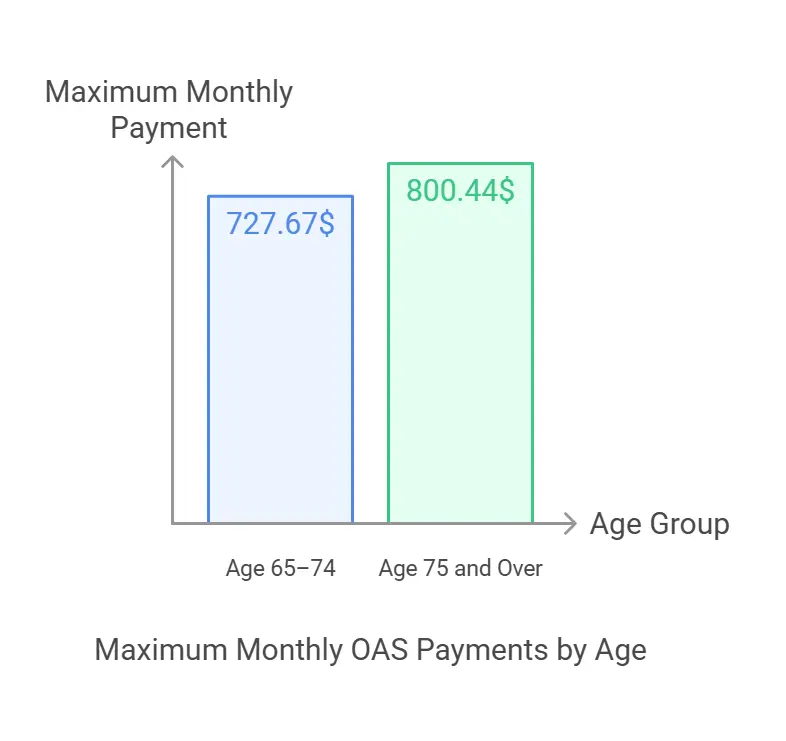

OAS Payment Amount

The OAS payment amount depends upon various factors. However, here is detailed information about how much you can get via OAS.

Benefit Type | Maximum Monthly Payment |

|---|---|

OAS (Age 65–74) | $727.67 |

OAS (Age 75 and Over) | $800.44 |

Review these OAS payment amounts to understand what you may be eligible for based on your age and circumstances.

Guaranteed Income Supplement (GIS)

Here’s a quick look at the Guaranteed Income Supplement (GIS) amounts and income limits for different recipient types.

Recipient Type | Maximum Monthly GIS |

|---|---|

Single, Widowed, or Divorced | $1,086.88 |

Married/Common-Law (Spouse Gets OAS) | $654.23 |

Married/Common-Law (Spouse Gets Allowance) | $654.23 |

Married/Common-Law (Spouse Doesn’t Get OAS/Allowance) | $1,086.88 |

Check where you qualify to ensure you’re receiving the right GIS support in 2025.

Allowance for the Survivor

Here’s an overview of the Allowance for the Survivor benefits, including maximum payments and income eligibility.

Benefit Type | Maximum Monthly Payment | Income Threshold |

|---|---|---|

Allowance (Spouse Gets GIS) | $1,381.90 | Combined Income Below $40,800 |

Allowance for the Survivor | $1,647.34 | Below $29,712 |

The payment amount can also be calculated using the OAS payment calculator. It is an easy way to calculate the increase or decrease in the payment amount.

Increase in Payment

Complete guidance about the OAS payment increase is provided below.

1. Next Adjustment (January to March 2025)

There is no payment increase in the first quarter of 2025. However, there is a rise in the payment as compared to January 2024.

2. Quarterly Adjustments:

3. Permanent Increase for Seniors Aged 75+:

Since July 2022, seniors aged 75 and older receive a 10% higher OAS payment compared to those aged 65–74.

The adjustments show that keep according to the inflation and provide financial help to the senior citizens.

Also Read Related Article OAS Clawback 2025

OAS Payment Methods

These two methods can be used to get the OAS payment amount. The details for both methods are provided below.

1. Direct Deposit Method

Old Age Security (OAS) direct deposit is a method through which the payment is received directly into a bank account. It is a fast, secure, and reliable method of payment deposit.

2. OAS Cheque Payment

You can also receive your payment through cheque. The cheque is mailed on the payment date. However, it takes some time to arrive.

Old Age Security Apply

Before you apply, check if you need to apply or not. Here is how you can check.

1. Check if You Need to Apply

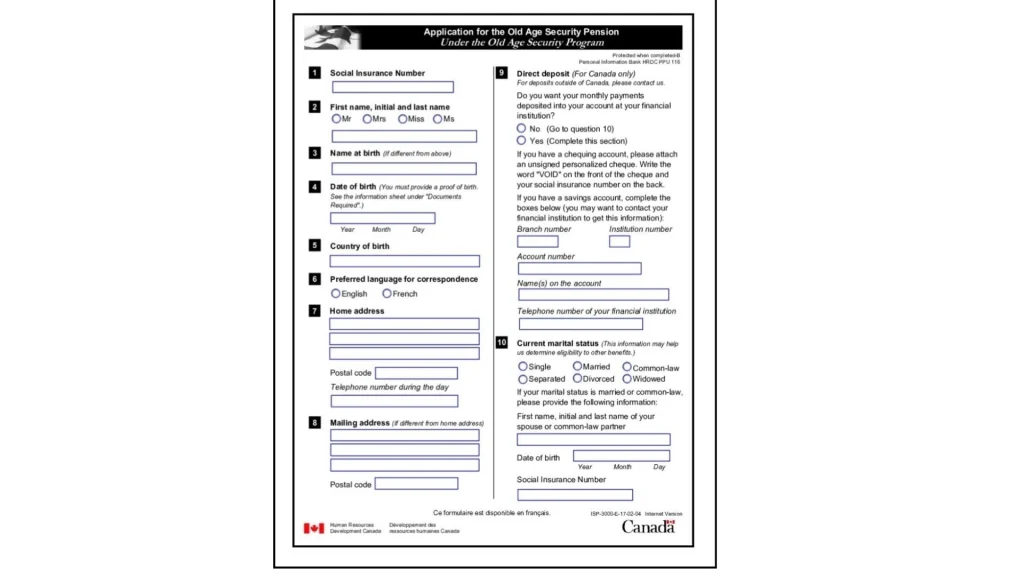

2. Apply Online

Applying for old age security pay includes a few simple steps. The step-by-step guidance to apply for OAS is provided below.

Once the application is submitted, wait for the response. Aspect a response from the Canada Service Center within 7 to 14 working days.

3. Apply Via Mail

Here is how you can apply via mail.

After the submission of the application, wait for the response. You will get a response within 120 working days.

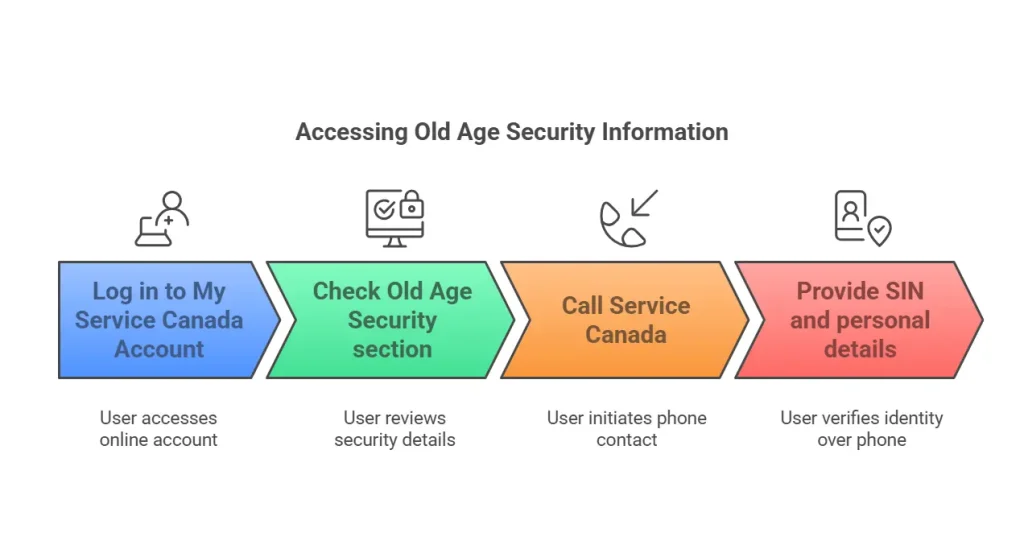

Track Application Status

Here’s how you can easily track the status of your Old Age Security application, whether online or offline.

Application Method | How to Track |

|---|---|

Online | Log in to My Service Canada Account and check the “Old Age Security” section. |

Offline (By Mail) | Call Service Canada at 1-800-277-9914 and provide your SIN and personal details. |

Use these methods to stay updated on your OAS application and ensure a smooth process.

Eligibility For OAS

The eligibility of Old Age security depends on the following factors.

1. General Eligibility

You must be 65 years or older to qualify For OAS. Your employment history does not affect your eligibility. This means you can still qualify even if you have never worked or if you are still working.

2. If You Live in Canada

You must:

3. If You Live Outside Canada

You must:

4. Canadians Working Abroad

If you worked outside Canada for a Canadian employer, time abroad counts as Canadian residency. This is valid if you came back to Canada within 6 months after ended your job or reached 65 while still working overseas and kept residency.

You’ll need to provide proof of employment from your employer and proof of returning to Canada, unless you turned 65 while working abroad.

5. Social Security Agreements

If you don’t meet residency requirements, you still qualify if you lived or worked in a country that has a social security agreement with Canada or contributed to that country’s system.

What Happens If Your Payment Is Late?

If you do not get your payment on the expected time, you will have to take the following precautions.

OAS Phone Number

The OAS phone numbers are given below. You can use these numbers to contact the Old Age Security Team.

FAQs

Conclusion

OAS Payments are an essential source of income for senior citizens in Canada.. Therefore, it is important to know the OAS payment dates to plan the finances and expenses.

You have two methods to receive the OAS payments that includes direct deposit and OAS cheque. If your payment are delayed, you can contact with Canada Service center for the help. You can also reach out the Service center for any kind of assistance.