Tax-Free Savings Account (TFSA) in Canada | Save & Grow Tax-Free

The Tax-Free Savings Account (TFSA) is a registered savings and investment account in Canada that allows individuals to earn tax-free income on eligible investments. Introduced in 2009, it has become a popular financial tool for Canadians due to its flexibility and tax advantages. Canadians can contribute up to $7,000 to their Tax-Free Savings Account (TFSA) in 2025. For those eligible since 2009 who never contributed, the total contribution room is $102,000 for tax-free savings and investment growth.

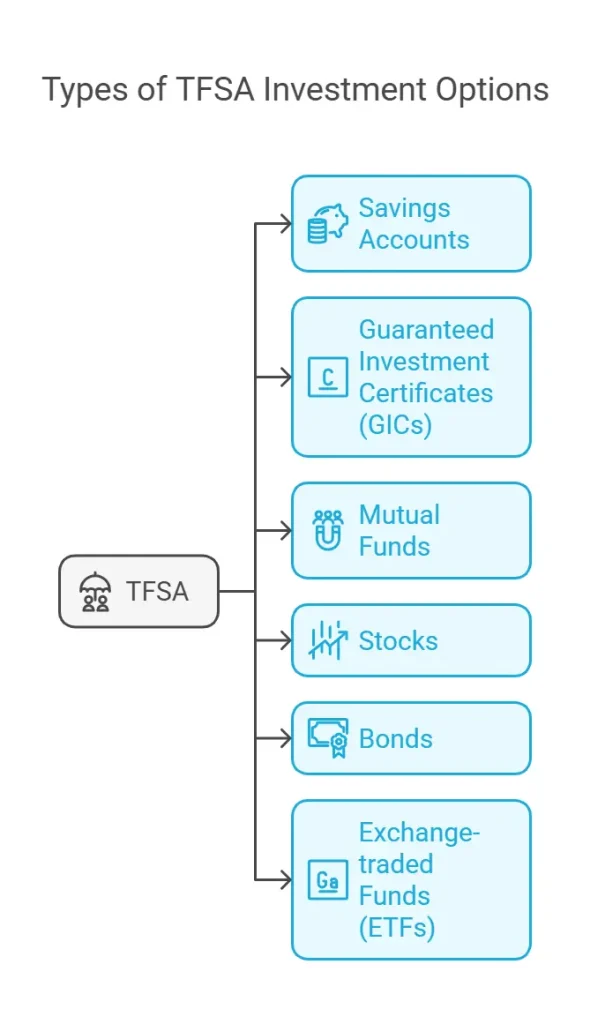

Types Of TFSA

In Canada, there are several types of Tax-Free Savings Accounts (TFSAs). Each type suits different financial goals and preferences. Here’s a simple overview of the main types:

1. Savings-Based TFSAs

These accounts function like traditional savings accounts but allow your money to grow tax-free. They are ideal for individuals looking for low-risk options to save for short-term goals or emergencies. Examples include high-interest TFSAs offered by banks like Tangerine, Manulife Bank, and Canadian Tire Bank.

2. Investment-Based TFSAs

These TFSAs allow you to hold various investments, such as stocks, bonds, mutual funds, ETFs, and GICs. They are suitable for individuals aiming for long-term growth and willing to take on some investment risk. Investors often use this type to maximize returns while benefiting from tax-free growth.

3. GIC-Based TFSAs

These accounts are specifically designed to hold Guaranteed Investment Certificates (GICs). GICs offer fixed returns over a set period and come in two types

4. Full-Service TFSAs

Offered by institutions like TD Canada Trust or RBC, these accounts provide access to a wide range of investment products alongside professional advisory services. They are ideal for individuals seeking expert guidance in managing their TFSA investments.

5. Multi-Holding TFSAs

These accounts combine savings and investment options within a single TFSA, allowing for diversification. For example, TD’s Multi-Holding TFSA lets you hold cash, mutual funds, stocks, and other investments in one account. This type of TFSA helps Canadians save tax-free and complements government benefits like Canada FPT payments.

Each type of TFSA offers unique features tailored to specific needs, whether you’re saving for short-term goals, building an emergency fund, or investing for long-term growth. Choosing the right type depends on your financial objectives and risk tolerance.

TFSA Eligibility

You must meet specific eligibility criteria to qualify for a TFSA. Here are the details about eligibility:

1. Eligibility for Canadians

Canadian citizens must meet these criteria:

These requirements ensure that only eligible individuals can open and contribute to a Tax-Free Savings Account in Canada.

2. Eligibility for Foreigners (Non-Residents)

Non-residents of Canada can hold a Tax-Free Savings Account , but they need to follow certain rules to avoid extra taxes or penalties.

Important Note:

- Contributions made while a non-resident are subject to a penalty tax of 1% per month on the contribution amount until withdrawn or residency is re-established.

- Non-residents do not accumulate new contribution room during their non-residency period.

- Withdrawals are tax-free in Canada but may be taxed in your home country depending on its tax laws.

How To Open A TFSA Account?

The process to open a TFSA account is very simple. Here’s how you can do it:

1. Confirm Eligibility

To open an account, you must meet specific eligibility requirements set by the Canadian government.

Meeting these criteria ensures you can take full advantage of the tax-free savings opportunities.

2. Choose a Financial Institution

Selecting the right financial institution is a key step in opening your account, as it impacts the types of investments and services available to you.

Pick an institution that matches your financial goals and makes it easy to manage your account.

3. Provide Required Documents

To open an account, you’ll need to provide essential documents to verify your identity and eligibility.

Once you’ve provided all the required documents, your account setup will be complete.

4. Decide on the Type of TFSA

Choose the type of TFSA that suits your needs. Options include:

The right TFSA helps you save more and reach your financial goals.

4. Fill Out the Application

The application form is a straightforward step toward opening your account.

Once submitted, your application will be reviewed, and your account will be ready to use shortly.

5. Start Contributing

After your account is approved, you can begin contributing up to your annual limit or any unused contribution room from previous years.

Regular contributions help grow your savings tax-free, making it easier to achieve both short- and long-term financial goals.

TFSA Contribution Room

Your TFSA contribution room is the maximum amount you can contribute to your TFSA in a given year. It is calculated as follows:

An Example of TFSA Contribution Room

If you had $3,000 unused contribution room at the end of 2024 and withdrew $2,000 that year, your total contribution room for 2025 would be:

Contribution Room = 7,000 + 3,000 + 2,000 = 12,000

TFSA Contribution Limit

The TFSA contribution limit for 2025 is $7,000, but your total contribution room includes unused limits from previous years and withdrawals from the prior year.

An Example of TFSA Contribution Limit

if you had $3,000 unused room and withdrew $2,000 in 2024, your 2025 contribution room would be $12,000. The lifetime contribution room for someone eligible since 2009 is $102,000 in 2025. Over-contributions incur a penalty of 1% per month, so track contributions carefully using CRA’s “My Account.”

Canada Tax-Free Savings Account Investments

In Canada, investments held in a Tax-Free Savings Account (TFSA) must fulfill certain criteria. These investments are classified as either qualified investments or non-qualified investments. Here is the in-depth guidance about TFSA qualified investments and non-qualified investments:

1. Qualified Investments

Qualified investments are allowed to be held in TFSA. Here is the list of qualified investments :

These types of investments are similar to those allowed in other registered plans, like RRSPs. They are designed to ensure tax-free growth within the TFSA framework

2. Non-Qualified Investments

Non-qualified investments are not allowed in the TFSA. The CRA does not also hold nonqualified investments in a TFSA. These investments include:

Keep in mind that holding non-qualified investments in a TFSA can lead to penalties. This includes a 50% tax on the fair market value of the non-qualified investment when acquired or when it became non-qualified. Also, note that any income or capital gains earned from these investments are also taxable.

TFSA Tracking

It is important to track Tax-Free Savings Account (TFSA) activities are essential to ensure you stay within your contribution limits and avoid penalties. Here’s a detailed overview of how to track TFSA activities based on official guidelines and available tools:

Using CRA’s Online Services

The Canada Revenue Agency (CRA) provides several online tools to monitor your TFSA activities. Here is a detailed guide to checking your TFSA online.

TFSA Withdrawals

Here is a detailed overview of TFSA withdrawals based on official guidelines:

1. How To Withdrawal

Here’s how to withdraw from a TFSA:

2. Key Features of TFSA Withdrawals

Here are some valuable features of TFSA:

These features make TFSA withdrawals flexible and tax-friendly, so Canadians can access their savings without penalties or limits.

3. Impact on Contribution Room

Here are the details about the impact of TFSA withdrawals on the contribution room:

1.1. Contribution Room Restoration

Any amount withdrawn from your TFSA is added back to your contribution room at the beginning of the following calendar year. For example, if you withdraw $5,000 in 2025, this amount will be added to your contribution room on January 1, 2026

1.2. Re-Contributions in the Same Year

If you wish to re-contribute the withdrawn amount in the same year, you can only do so if you have unused contribution room available for that year. Otherwise, it will be considered an over-contribution and subject to a penalty tax of 1% per month on the excess amount

For Example Case 1: Waiting Until Next Year:

Suppose you contributed the maximum limit for 2025 ($7,000) and later withdrew $3,000 in July 2025. You cannot re-contribute this $3,000 until January 1, 2026, when it will be added back to your contribution room.

Case 2: Over-Contribution Penalty:

If you re-contribute the $3,000 withdrawal in December 2025 without available contribution room, it will result in an over-contribution. You will incur a penalty of 1% per month on the excess amount until it is withdrawn or until an additional contribution room becomes available. be added back to your contribution room.

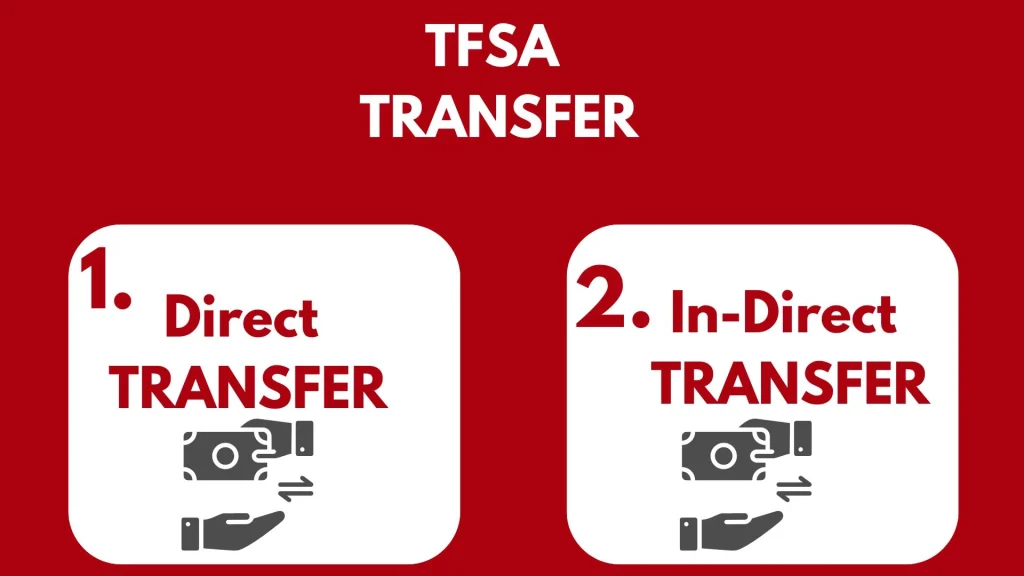

TFSA Transfer

A TFSA transfer is the process of moving funds or investments from one Tax-Free Savings Account (TFSA) to another. This can be done without tax consequences if it is a direct transfer initiated by the financial institutions involved. Here’s a detailed overview:

1. Types of TFSA Transfers

There are two types of transfer.

1.1. Direct Transfer

A direct transfer is the easiest way to move funds between TFSAs. Here is the complete guide.

This process ensures no penalties, taxes, or impact on your contribution room.

1.2. Indirect Transfer

An indirect transfer occurs when you withdraw funds from one TFSA and deposit them into another yourself, rather than using a direct transfer. This method reduces your contribution room and leads to penalties if you exceed your annual limit.

2. Special Cases for Transfers

Between Spouses (Divorce/Separation):

Upon Death:

TFSA Beneficiaries

There are two main options for TFSA Canada Beneficiaries:

1. Successor Holder

Here are the details about the success holder:

2. Beneficiary

The details about the beneficiary is as follows:

FAQs

Conclusion

The Tax-Free Savings Account (TFSA) is a versatile and powerful tool for Canadians to grow their savings and investments tax-free. By understanding its rules, including contribution limits, withdrawal policies, and beneficiary designations, individuals can maximize the benefits of their TFSA while avoiding penalties. Proper management of this account ensures a tax-efficient way to secure financial stability and achieve personal objectives.