RC210 or Regular CWB ? Make Sure You’re Getting the Right Amount

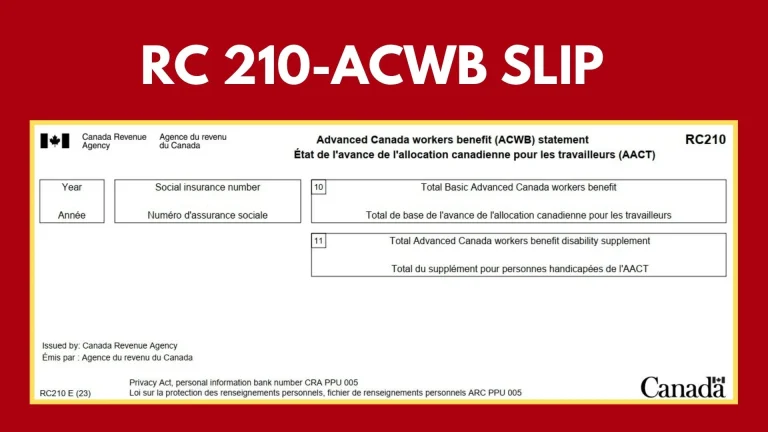

Canada Workers Benefits provides financial support to help low-income individuals and families. However, there are two ways to access this benefit. One is through regular CWB payments at tax time and the other is advance payments reported on the RC210 slip. While both are part of the same program, they work differently. Here is the…