Canada Carbon Rebate Small Businesses payment Dates For 2025

The Canada Revenue Agency announced the Canada Carbon Rebate for Small Businesses in the 2024 Federal Budget. It is a non-taxable rebate launched to help small businesses overcome the financial burden of carbon pricing. Below is the complete idea about Business Tax Rebate 2025 including payment dates, amounts, and eligibility criteria.

Business Tax Rebate Payment Dates

The CCR for Small Businesses payments dates for 2025 are scheduled as follows:

Payment | Date |

|---|---|

First Payment | January 15, 2025 (already issued) |

Second Payment | April 15, 2025 |

Third Payment | July 15, 2025 |

Fourth Payment | October 15, 2025 |

Note: If the 15th falls on a weekend or a statutory holiday, payments will be issued on the last business day before the 15th. In case, your payment is delayed, wait for 5 working days before contacting CRA.

The CRA updates about the next payment dates and other upcoming updates at MY CRA Account. Keep an eye on the payment calendar to receive timely payments.

Canada Carbon Rebate For Business Details

Here are the details about the Business carbon tax rebate:

Detail | Information |

|---|---|

Name | Canada Carbon Rebate for Small Businesses |

Start Date | Announced in Budget 2024, payments began in December 2024 |

Launched By | Government of Canada, administered by the Canada Revenue Agency (CRA) |

Purpose | To return a portion of federal fuel charge proceeds to small and medium-sized businesses |

Target Beneficiaries | Canadian-Controlled Private Corporations (CCPCs) with 1–499 employees |

Rebate Amount | Varies by province and number of employees |

Deputy Prime Minister and Finance Minister Chrystia Freeland confirmed in November 2024 that the rebate would be tax-free. The CRA gives the Canada Carbon Rebate to small businesses, and FTP payments help with taxes, making it simple to handle money.

Small Business Carbon Rebate Payment Amount

The rebate payment amounts vary based on province and the number of employees in your business. Here are the details about payment amounts for 2025 in eligible provinces of Canada.

Province | 2025 Payment Rate Per Employee |

|---|---|

Alberta | $181 |

Saskatchewan | $233 |

Manitoba | $168 |

Ontario | $146 |

New Brunswick | $87 |

Nova Scotia | $119 |

Prince Edward Island | $82 |

Newfoundland and Labrador | $179 |

Note: An employee’s province of employment is based on their T4 slip (box 10). If they have multiple T4 slips, count them only once, in the province where their pay (box 14) was highest.

Also Read Related Article Canada Carbon Rebate (CCR) Payment Dates 2025 For Individuals

The rebate amount is calculated by multiplying the number of employees in your business by the applicable rate for your province. If an employee worked in multiple provinces, include them under the province where their highest remuneration (T4 Box 14) was earned.

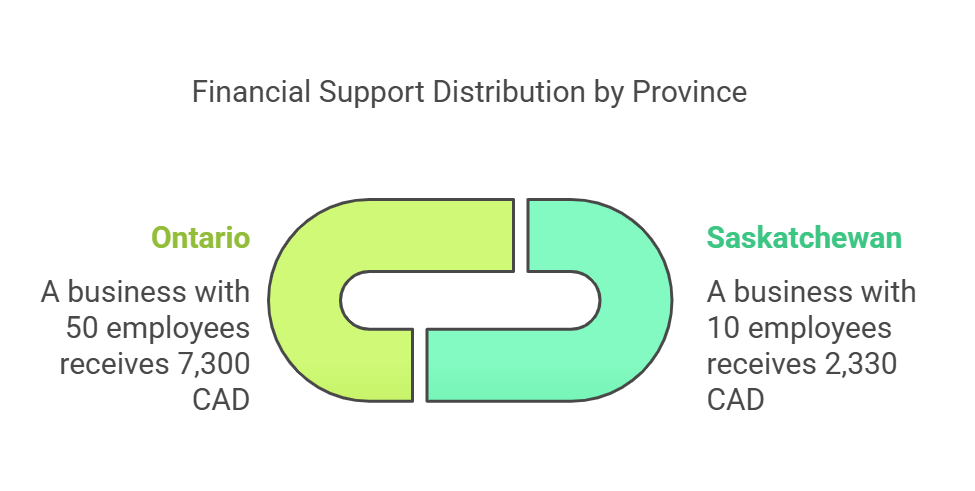

Example :

- Saskatchewan:

A business with 10 employees would receive: 10 × 233 = 2,330 CAD - Ontario:

A business with 50 employees would receive: 50 × 146 = 7,300 CAD

Payment Methods

The CRA offers two methods for the rebate payment. Here is the details about the payment methods:

1. Direct Deposit

If your business is signed up for direct deposit with the CRA, the rebate will be deposited directly into your bank account. It will appear as “Canada Carbon Rebate” (the exact wording may vary depending on your bank). It is a fast and reliable method to receive payments.

2. Cheque

If your business isn’t registered for direct deposit, the rebate will be mailed to you as a cheque. The cheque deposits are slow and take time to arrive.

Carbon Business Cridet Eligibility Criteria

Here are the eligibility criteria for the Canada Carbon Tax Rebate for Small Businesses in 2025:

Eligible and ineligible provinces for Business carbon tax rebate

Here are the eligibility criteria for the Canada Carbon Tax Rebate for Small Businesses in 2025:

Category | Provinces/Territories |

|---|---|

Eligible Provinces | Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island (PEI), Newfoundland and Labrador |

Ineligible Provinces/Territories | British Columbia, Quebec, Yukon, Northwest Territories, Nunavut |

How To Apply For Carbon Tax Business Rebate

There is no separate need to apply for this rebate. The Canada Revenue Agency (CRA) automatically calculates and issues the rebate to eligible businesses. To get qualified, ensure that you have fulfilled all the eligibility criteria.

Carbon Business Rebate Payment Problems

Here are the details about the payment problems along with their reasons:

1. Didn’t Receive a Payment

There are several reasons why you may not have received your rebate:

Additionally, CRA conducts thorough reviews to detect fraud or suspicious activity. Some payments may be delayed until these validations are complete.

2. Different Payment amount

Use CRA’s online estimator tool to calculate your rebate and compare it to what you received. Common reasons for discrepancies include:

Helpline Details

Here are the helpline details for the Canada Revenue Agency (CRA) if you need assistance with the Canada Carbon Rebate.

General Business Inquiries

If you have any general questions, contact CRA at this phone number:

1-800-959-5525

The service hours for this phone number are as follows:

- Monday to Friday: 8:00 AM to 8:00 PM (local time)

- Saturday: 9:00 AM to 5:00 PM (local time)

This is the helpline number of the Canada Revenue Agency. If you are facing any kind of issue related to small business tax credit and other tax-related concerns, contact this phone number.

FAQs

Conclusion

The Canada Carbon Rebate For Small Businesses is the most important financial support to small business in Canada. This rebate helps the business to overcome carbon-increasing prices like fuel and gas.

Details like CCR for small businesses eligibility, payment dates, and amounts are necessary to know. Above we have provided detailed information about the CCR small businesses program. If you have still any issues, reach out to the CRA through the helpline number for assistance.