Claim These CRA Low-Income Benefits Before It’s Too Late!

If you’re a low-income earner in Canada, the Canada Revenue Agency (CRA) offers a variety of benefits to help ease financial burdens. These benefits are designed to support individuals and families by supplementing income, reducing tax liabilities, and covering essential expenses. In this blog, i will explain each benefit in detail, provide actionable tips, and ensure you have all the information you need to claim what’s rightfully yours.

1. Canada Workers Benefit (CWB)

The Canada Workers Benefit (CWB) is a refundable tax credit that helps low-income workers by supplementing their earnings. It’s especially beneficial for those who are employed but struggling to make ends meet.

Now the question arise that how Much Can You Get? Here is the answer to your question based on your status:

Single individuals:

For Families it is:

As a Disability Supplement, additional $784 annually is given to for eligible individuals.

Also Read Related Article 5 CRA Payments Coming in February 2025 | Don’t Miss a Dollar!

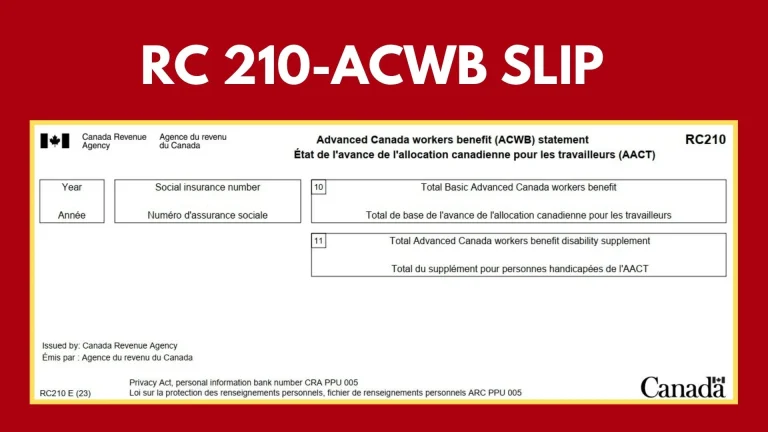

Advance Payments

You also have a choice to receive up to 50% of your CWB in advance payments throughout the year instead of waiting until tax season.

Tip: File your taxes on time to ensure you qualify automatically for the CWB. If you have a disability, submit Form T2201 to claim the disability supplement. Also consider opting for advance payments if you need financial support throughout the year rather than waiting for a lump sum at tax time.

2. GST/HST Credit

The GST/HST Credit is a quarterly payment aimed at helping low-income Canadians offset the cost of goods and services tax (GST) or harmonized sales tax (HST). This credit is automatically assessed when you file your tax return.

Now the question arise that how Much Can You Get from GST/HST Credit? Here is the answer to your question based on your status:

But there are some income threshold as listed below:

Don’t Forget to calculate your interest and benefits through CD calculator.

Keep your marital status and number of dependents updated with the CRA to avoid payment delays or inaccuracies. Even if you have no taxable income, file your taxes to receive this credit automatically.

3. Canada Child Benefit (CCB)

The Canada Child Benefit (CCB) is a tax-free monthly payment designed to help families with children under 18 years old cover childcare and other essential expenses.

Now the interesting question, how Much Can You Get from CCB? Here is the answer to your question based on your status:

But there is a criteria that you need to follow as:

Families with an adjusted family net income (AFNI) below $36,502 receive the maximum benefit amount. Payments decrease as income rises above this threshold.

Tip: Notify the CRA immediately if your family income changes significantly during the year so they can adjust your payments accordingly. Ensure your marital status and number of children are updated in your CRA account to avoid underpayments or overpayments.

4. Canada Dental Benefit

Dental care can be expensive, but the Canada Dental Benefit offers temporary assistance for families earning less than $90,000 annually with children under 12 years old.

The payment amount varies based on family income:

Keep receipts for all dental expenses as proof when applying for this benefit. Apply through CRA My Account or by phone for faster processing.

5. Disability Tax Credit (DTC)

The Disability Tax Credit (DTC) is a non-refundable tax credit that reduces taxable income for individuals with severe physical or mental impairments.

The payment amount varies based on following factors:

Submit Form T2201 certified by a medical professional as early as possible to avoid delays in approval. If approved, check if you qualify for retroactive payments for previous years.

6. Provincial and Territorial Benefits

In addition to federal programs, many provinces offer their own benefits tailored for low-income residents:

Province/Territory | Maximum Annual Amounts |

|---|---|

BC Climate Action Tax Credit | Individual: $504; Spouse: $252; Child: $126 ($252 for first child in single-parent families). |

Ontario Sales Tax Credit | Up to $360 per adult/child |

Alberta Child & Family Benefit | Up to $5,120 annually for families with four children under certain income thresholds |

Check your province’s specific programs as eligibility criteria and amounts vary widely. Most provincial benefits are issued automatically when you file your federal tax return—ensure all information on your return is accurate.

7. Refundable Medical Expense Supplement

This supplement provides additional financial relief if you incur significant medical expenses relative to your modest income.

How Much Can You Get?

You may receive up to $1,316 annually if eligible.

Keep all medical receipts organized and ensure they meet CRA’s eligibility criteria. Use CRA’s My Account portal to track any credits related to medical expenses.

My Final Thoughts

The CRA offers numerous benefits designed specifically for low-income Canadians—but many people miss out simply because they don’t know about them or fail to file their taxes on time! Whether it’s the Canada Workers Benefit (CWB), GST/HST Credit, or Canada Child Benefit (CCB), these programs can make a significant difference in managing financial stress.

![Canada GST/HST Relief Tax Break for 2025 [ Save More This Year ]](https://paymentdates.org/wp-content/uploads/2025/02/GSTHST-TAX-RELEIF-2025-768x432.webp)