Canada Workers Benefits ( CWB ) Enhancments 2025

The Canada Workers Benefit (CWB) is a federal refundable tax credit designed to support low-income workers in Canada. Recent CWB enhancements have broadened its reach, increased financial assistance, and introduced advanced payment options to provide timely support. CWB payment dates for 2025 in Canada are scheduled quarterly to support eligible low-income workers and families.

Major Enhancements to CWB

Several Canada worker’s benefits (CWB) enhancements have been introduced in recent years. Here are the details about the enhancements that had a huge impact on CWB.

1. Increased Maximum Benefit Amounts

The CWB payment amounts have been increased in recent enhancements. Here is the detailed guide to the impact on the payment amounts due to enhancements:

Examples of Increased Maximum Benefit Amounts

For a single worker earning $26,000 annually:

- The benefit reduction rate is 12% for every dollar above $24,975.

- Reduction = (26,000−24,975) × 0.12 = 123

- Final benefit = 1,518−123 = 1,395

For a family earning $30,000 annually:

- Reduction starts at $28,494 with a rate of 15%.

- Reduction = (30,000−28,494) × 0.15= 226

- Final benefit = 2,616−226=2,390

2. Advanced Canada Workers Benefits (ACWB)

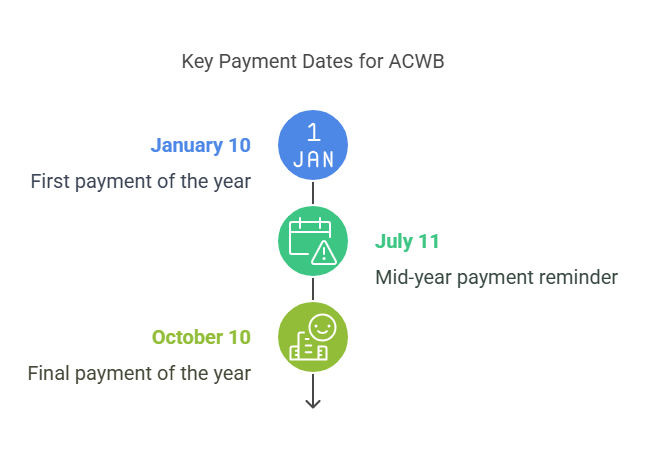

ACWB is one of the most beneficial enhancements. According to ACWB, eligible recipients are allowed to receive up to 50% of their estimated annual benefit in quarterly installments. This ensures financial support throughout the year.

The payment schedule for ACWB is as

Also Read Related Article RC210 or Regular CWB ? Make Sure You’re Getting the Right Amount

An Example of ACWB

If a single worker qualifies for $1,518 annually:

- Advance payments = 1,518×0.5= 759

- Quarterly payments = 759/3= 253

Keep in mind that ACWB is only available for eligible individuals. The CRA determines the eligibility and offers ACWB payments.

3. Expanded Eligibility

The CWB enhancements have broadened the eligibility for Canadian worker’s benefits. For single individuals without dependents, the phase-in threshold rose from $13,194 to $22,944.

In addition to that, the lower-income spouse can exclude up to $14,000 of their working income when calculating adjusted net income. This reduces the phase-out rate for families.

4. Secondary Earner Exemption:

Secondary Earner Exemption is one of the most helpful changes in Canadian workers benefits. According to it, couples can exclude up to $14,000 of the lower earner’s income when calculating their combined income for the Canada Workers Benefit. This helps reduce reductions in benefits and allows dual-income families to receive more financial support.

All these enhancements were made in the CWB. This change provides more flexibility and financial aid to Canadian workers. The enhancement ensures that more individuals can get the benefits.

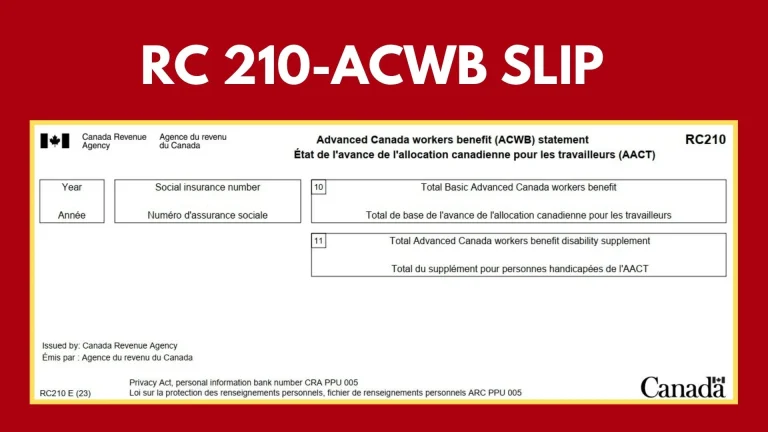

Also Read Related Article RC210 ACWB Statement | Important Details for 2025 Payments

Impact of Enhancements

The enhancements are introduced to provide more financial relief to low-income workers and families. The enhancements to CWB are a unique way to reduce poverty and support low-income Canadians and their families. The recent enhancements such as payment increases, ACWB had a positive impact on the eligible individuals.

Conclusion

The enhancements to the Canada Workers Benefit (CWB) were introduced to provide greater financial support to low-income workers, reduce poverty, and encourage workforce participation. The major changes such as increased payment amounts and extended eligibility ensure that more individuals and families can qualify.

These changes aim to make work more rewarding, helping workers cover essential expenses like rent, food, and childcare. The introduction of advance payments allows eligible recipients to receive part of their benefits throughout the year, offering timely relief amid rising living costs.