Filing Taxes with an RC210 Slip | 5 Common Mistakes to Avoid In 2025

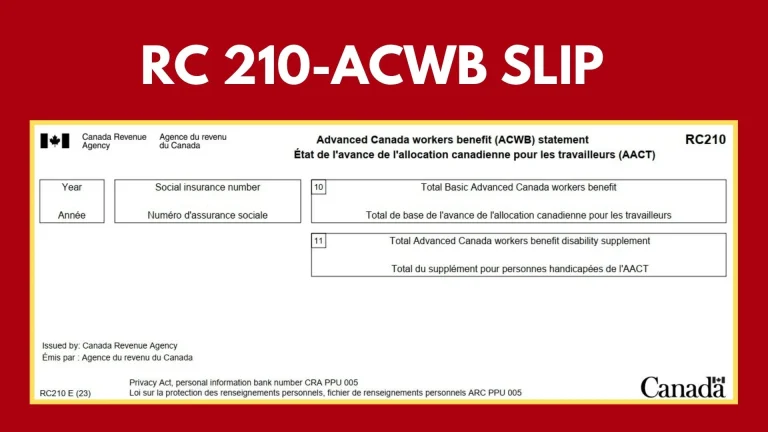

The RC210 slip is an important document for individuals who received Advanced Canada Workers Benefit (ACWB) payments. It reports the amounts received in advance, which must be reconciled when filing your tax return. The process of filing taxes with an RC210 slip is simple, but many taxpayers make mistakes that can lead to delays, incorrect refunds, or even penalties. Here are common mistakes to avoid when filing taxes with an RC210 slip in 2025.

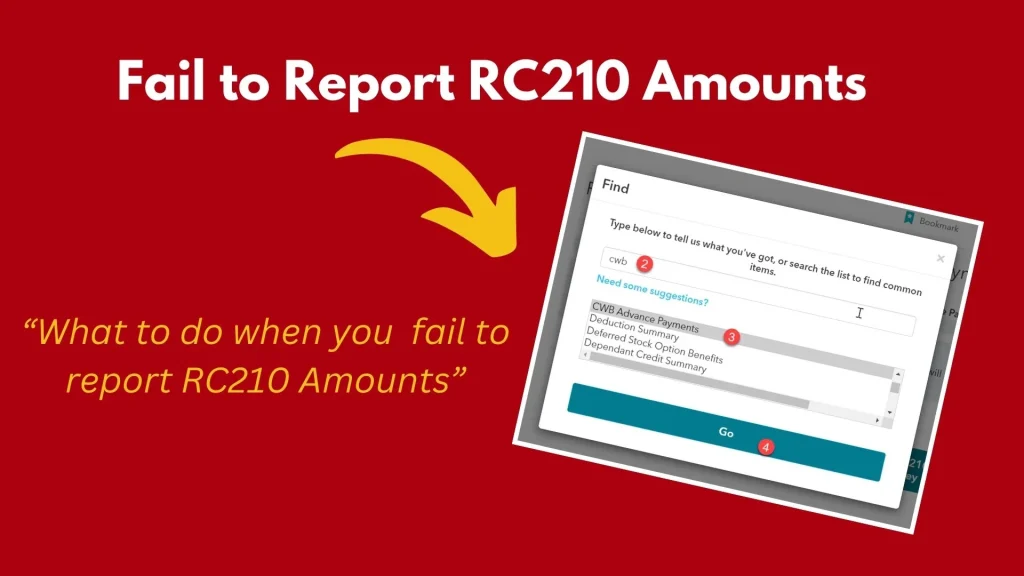

1. Fail to Report RC210 Amounts for 2025

A common mistake is forgetting to add the amounts from the RC210 slip on your tax return. You need to report the total ACWB amount (Box 10) and any disability supplement (Box 11) on Schedule 6 and enter them on line 41500.

If you don’t report amounts, the Canada Revenue Agency (CRA) will adjust your return, which could lower your refund or increase the taxes you need to pay.

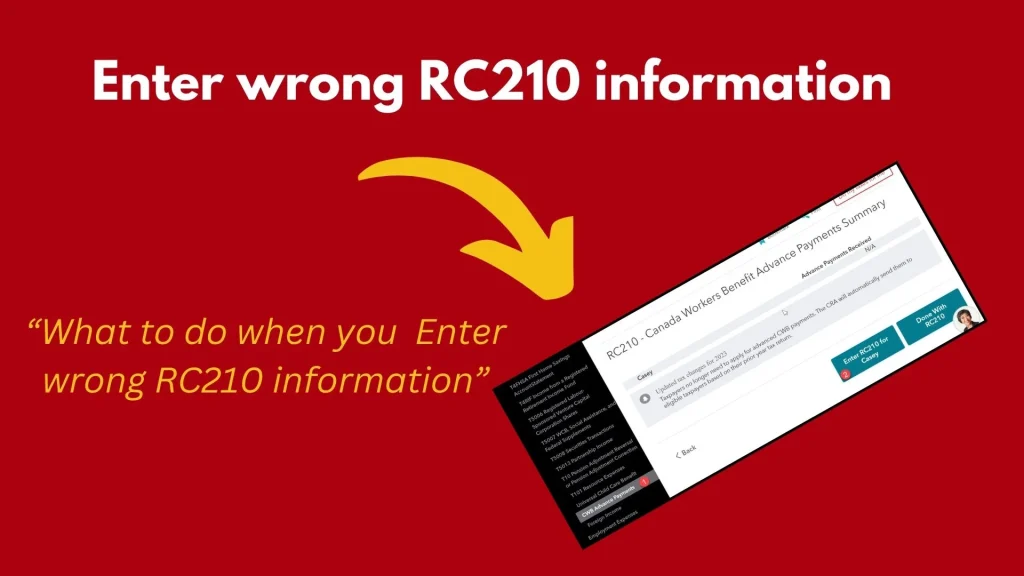

2. Enter wrong RC210 information

Mistakes in amounts from the RC210 slip cause problems with your tax return. For example:

To avoid this, double-check the information on your slip and make sure it matches what you enter in your tax software or forms.

3. Ignore Spousal Reporting Rules

If you have a spouse or common-law partner, only one of you should report the total ACWB amount from Box 10 of all RC210 slips received by both partners. If neither of you is eligible for the basic CWB, one partner must still report it as if they were eligible. Incorrectly splitting or duplicating amounts can cause errors in your return.

Also Read Related Article Canada Workers Benefits ( CWB ) Enhancments 2025

4. Tax Software for RC210 Slip Filing

If you’re using tax software like TurboTax or H&R Block, go to the section for entering RC210 information. In H&R Block, you’ll find it under “Government slips” and can enter the information directly on the RC210 page.

5. Incorrect eligibility for the CWB

Some taxpayers mistakenly claim the CWB when they are not eligible, like full-time students who don’t meet the income requirements. If you received ACWB payments but aren’t eligible for the CWB based on your income, you need to repay any extra payments. Always check your eligibility before filing.

Also Read Related Article RC210 or Regular CWB ? Make Sure You’re Getting the Right Amount

Tips for Filing with an RC210 Slip Accurately

Also Read Related Article RC210 ACWB Statement | Important Details for 2025 Payments

Avoid these common mistakes and review your tax return carefully to ensure a smooth process with an RC210 slip. Double-check all amounts and ensure they match the information on your slip. Check your eligibility and make sure all details are correct before you file your return. This helps you get the full Canada Workers Benefit and prevents delays, penalties, or repayments.

Conclusion

Report all RC210 amounts, including Box 10 and Box 11, on Schedule 6 and line 41500 accurately. If you have a spouse or common-law partner, only one of you should report the total ACWB amount. Verify your eligibility for the Canada Workers Benefit (CWB) to avoid repayments or penalties. Use the CRA’s Auto-Fill My Return (AFR) feature and review all entries before submitting your return. Filing on time with accurate details ensures a smooth process and avoids delays or penalties.