GST/HST Credit Payment (Official) Dates Canada in 2025

GST/HST credits are a source of financial support to low income families of Canada. The Canada Revenue Agency (CRA) has officially announced the GST/HST payment dates 2025. All other guidelines such as payment amounts, eligibility, deposit methods and retroactive payments are announced 2025. The CRA also announces extra payments to provide financial support to Canadians. The guideline about GST/HST tax filing has also been announced by CRA.

GST/HST Payment Dates

The Canada Revenue Agency splits payment dates into four equal quarters. The payment schedule is as follows.

Month | Payment Date |

First Payment | Friday, January 3, 2025 |

Second Payment | Friday, April 4, 2025 |

Third Payment | Friday, July 4, 2025 |

Fourth Payment | Friday, October 3, 2025 |

If your payment does not arrive within ten working days, instantly contact CRA at 1-800-387-1193. The CRA will assist you with the payment delay.

GST Payment Details

Here is a quick overview about GST/HST payments and credits.

Category | Details |

|---|---|

Payment Name | GST/HST Credit |

Base Year for Calculation | 2023 income tax return |

Payment Frequency | Quarterly |

Payment Method | Direct deposit (recommended) and mailed cheque |

Administered By | Canada Revenue Agency (CRA) |

The GST/HST payments are a part of Canada FPT payments. The GST/HST credit is a tax-free quarterly payment provided by the Canada Revenue Agency (CRA) . It helps the low income citizens to offset the cost of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

1. GST and HST Payment Amounts

The GST and HST credit amount depends upon various factors including net income, family status, and children under your care. Below is a detailed piece of information about it.

The total amount is split into four parts of $214.75 each on January 3, April 4, July 4, and October 3, 2025.

2. GST Extra Payments

The government announces GST/HST extra payment as a one-time payment of 250$ to eligible individuals. You do not need to apply for it. If you are eligible for it, you will automatically get extra credit.

It is an additional payment with regular payment. The payment dates for extra payments are the same as regular payments.

This increase in the GST payments is announced to support citizens in daily life finances.

Also Read Related Article Canada GST/HST Relief Tax Break for 2025 [ Save More This Year ]

GST And HST Credit Calculations

The credit amount depends on:

- Adjusted Family Net Income (AFNI): This includes your net income (line 23600 of your tax return) and, if applicable, your spouse or common-law partner’s net income.

- Marital Status: Whether you are single, married, or in a common-law partnership.

- Number of Eligible Children: Children under 19 years old registered for the Canada Child Benefit (CCB) and GST/HST credit.

Also Read Related Article GST/HST Credit Income Limit 2025 [ Final Reminder ]

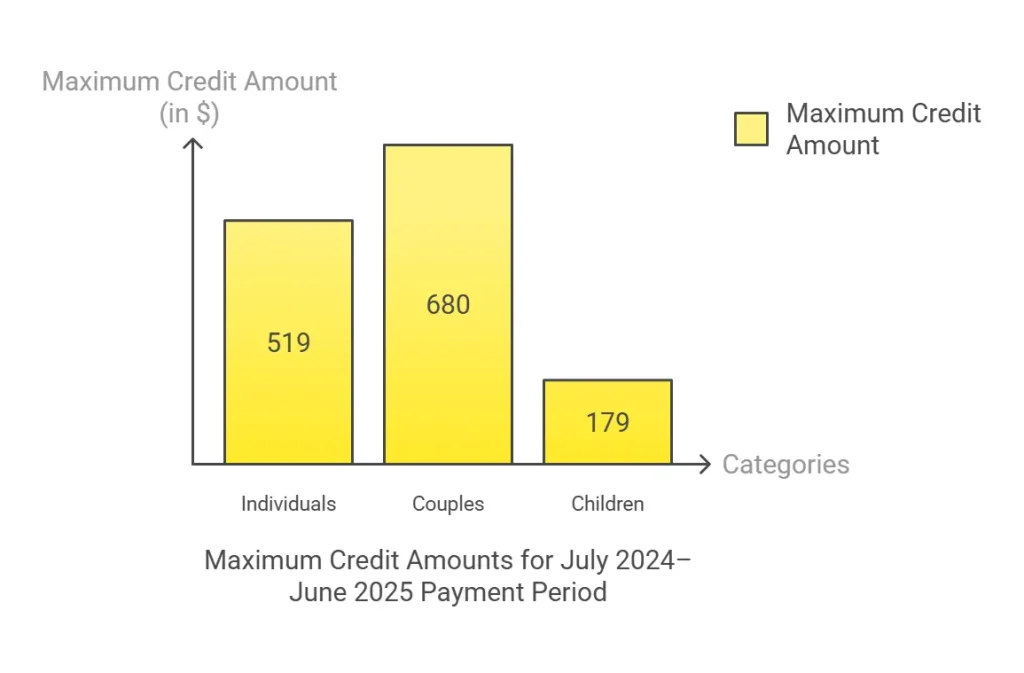

1. Maximum Credit Amounts for July 2024–June 2025 Payment Period

2. Phase-Out Reduction

The credit begins to phase out when AFNI exceeds certain thresholds:

- For single individuals: The credit is reduced by 5% of the amount by which AFNI exceeds approximately $42,335.

- For families: The phase-out threshold depends on family size and income level. For example, a family of four earning above $54,704 will see their credit gradually reduced until it is eliminated at higher income levels.

Example Calculation

For a married couple with two children under 19 and an AFNI of $50,000:

If your total annual credit is less than $50 per quarter, you will receive a lump-sum payment in July.

3. GST Extra Payments

The credit recalculations are done by CRA when:

In this case, the CRA sends a Redetermination notification that contains the information about updated credit.

4. Credit Overpayment

Sometimes, the CRA pays over credit than the expected amount. In this situation, the following precautions are adopted by CRA.

If you think that you have received an overpayment notification but not overpaid, immediately contact the Canada Revenue Agency. Report your issue to CRA and CRA will assist you.

How To Apply

The application process is straightforward and includes a few easy steps. You can apply as follows.

1. For Canada Residents

For Canadian residents, there is no separate need to apply for the GST/HST credit. You just need to file your taxes on time, and the CRA will automatically check your eligibility and issue payments

2. For New Residents Of Canada

If you are a new resident of Canada, here is a step-by-step guide to how to apply for HST/HST payments.

Submit your application as soon as possible and ensure the form’s accuracy to avoid delays.

Eligibility Criteria

The eligibility of an individual depends upon various factors. The details are as follows.

Age Requirements

Residency

You must be a resident of Canada during the month before and at the start of the month when the payment is issued.

Eligible Provinces and Territories

The eligible provinces and territories for GST HST payments are as follows

Provinces

Territories

The CRA provides GST/HST credits only to the residents of above-mentioned provinces and territories of Canada.

Payment Methods

The Canada Revenue Agency has introduced the two deposit methods for GST/HST credit. You have the authority to choose your payment method between the two. Here is a detailed guide about it.

1. Direct Deposit

Direct deposit is the safe and fast method in which payments are directly sent into bank accounts. In this method, payments arrive within five working days. That’s why it is the most used method for payment deposits.

To step up direct deposit, follow the below provided guidance:

1.1. Online via CRA My Account

To setup direct deposit via MY CRA account:

It is the fastest, reliable and most used method to set up direct deposit.

1.2. Through Your Financial Institution

Most Canadian banks and credit unions allow the users to sign up for CRA direct deposit directly. It is done via their online or mobile banking platforms. Here is how to do it:

In case, if you face any kind of issue, contact your financial institution. Your Financial institution guides you and helps you to set up direct deposit.

By Phone

The option to sort direct deposit via number is also available. For this purpose, call CRA at 1-800-959-8281.You will be asked to provide following details:

By Mail

The CRA offers to set up direct deposit via paper form. Here is how to do it:

- Always provide valid and updated information to prevent delays and errors.

- Do not close your old bank account until you confirm that payments are being deposited into your new account.

- If you have never filed a tax return with the CRA, you must first register your SIN by calling the CRA before enrolling for direct deposit

2. Cheque Method

In the cheque method, payments are sent via paper cheque to the mail address. This method is competitively slow and older. The cheques take 10 working days to arrive after the expected date.

GST/HST Retroactive Credit payments

In the cheque method, payments are sent via paper cheque to the mail address. This method is competitively slow and older. The cheques take 10 working days to arrive after the expected date.

Retroactive GST/HST credit gives unpaid tax benefits from earlier years. It means asking the government for GST and HST credits if you have missed your previous year’s credits.

The government pays the retroactive credit for up to 10 years. For example, it’s 2025 and you can claim credits for 2010. However, filing your taxes before asking for retroactive payments is necessary.

How To Claim Retroactive Payments

Write a request letter and send it to CRA for retroactive payments. If you are new in Canada, there is no need to apply for retroactive payments. Just fill out the RC151 form and send it to CRA

Tips for Smooth Payments

These practical tips will help you for smooth payments.

FAQs

Conclusion

The GST and HST payments are a source of financial support for Canadian citizens. You can make timely and easy free payments by Keeping an eye on the payment dates. The payment amounts, eligibility criteria and deposit methods are also necessary to know.

Above we have provided in depth details about Goods and Services Tax and Harmonized Sales Tax. If you face any issue, feel free to contact us.