RC210 ACWB Statement | Important Details for 2025 Payments

The RC210 slip is a form associated with the Canada Workers Benefit (CWB). The RC210 slip helps manage finances in a better way. Below are the in-depth details about the RC210 ACWB statement for 2025.

What Is RC210 ACWB Statment

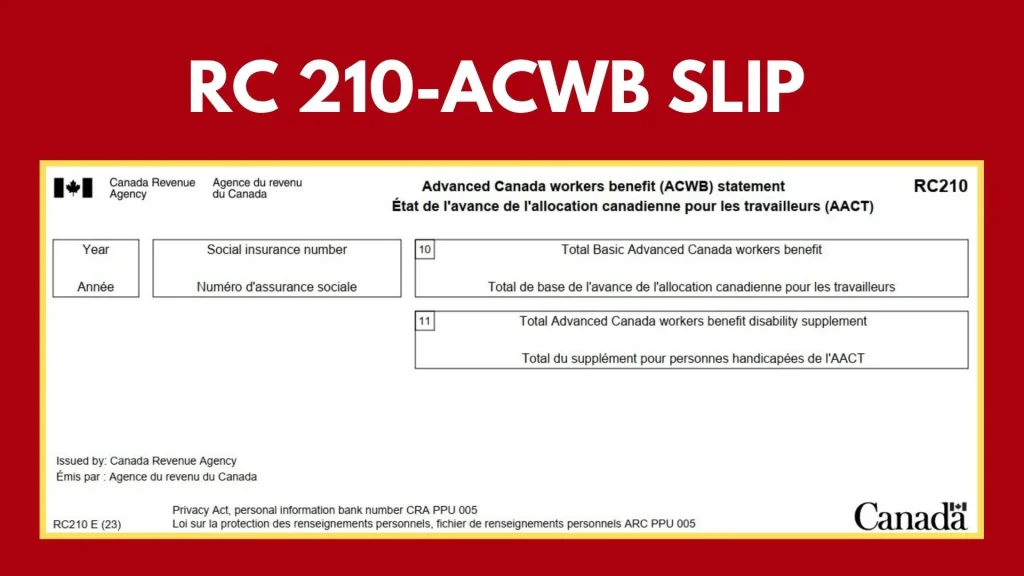

The RC210 is a tax slip issued by the Canada Revenue Agency (CRA). It contains all the records of advance payments you received under the Canada Workers Benefit (CWB) program.

The CWB is a refundable tax credit that helps low-income workers and families. Instead of waiting until tax season to claim this benefit, eligible individuals can receive up to 50% of their estimated CWB in advance payments throughout the year. The total records of advanced payments are saved via the RC 210 ACWB form.

Also Read Related Article Canada Workers Benefits ( CWB ) Enhancments 2025

Why Does the RC210 Tax Slip Matter?

The rc210 tax slip ensures transparency and accountability for the advance payments you receive. It helps you track how much of your benefit has already been paid out. This way, you can reconcile these amounts on your return when tax season arrives. In short, this slip contains all the records of your ACWB payments.

How Does the RC210 Work?

The RC210 statement plays a key role in managing your Canada Workers Benefit (CWB) advance payments. It helps eligible individuals to receive quarterly payments instead of waiting for a lump sum at tax time.

The RC210 slip contains all the records of your ACWB payments, that must be reported when filing taxes. During tax filing, the CRA reconciles these payments with your actual income.

If you earned more than estimated, you may need to repay some of the benefit. If you earned less, you could receive additional funds as part of your refund. This process ensures accurate benefit distribution and helps avoid overpayments or underpayments.

Also Read Related Article Filing Taxes with an RC210 Slip: 5 Common Mistakes to Avoid In 2025

What Information Does the RC210 Contain?

The RC210 slip includes two key pieces of information:

Example :

For instance, if your RC210 slip shows $600 in Box 10 and $200 in Box 11, you must report $600 on line 38120 and $200 on line 38122 of Schedule 6. This ensures the CRA correctly calculates your remaining CWB entitlement or any repayment required.

These amounts must be entered on specific lines in Schedule 6 of your tax return.

How Do You Use the RC210 When Filing Taxes?

When it’s time to file your taxes, follow these steps:

If you’ve received more in advance payments than you’re entitled to based on your final income, you’ll need to repay the difference. Conversely, if you’re owed more, it will be added to your refund.

How To Get RC210 Slip

There are certain ways through which you get your slip. Here is a detailed guide about it:

1. CRA My Account

Log in to your CRA My Account online. Under the “Benefits and Credits” tab, you can access and download your RC210 slip. This is the most convenient way to retrieve it if you’ve misplaced the physical copy.

2. Paper Slip by Mail

The CRA typically sends the RC210 slip by mail to eligible individuals. Ensure your mailing address is up-to-date with the CRA to receive it on time.

3. Contact CRA

If you haven’t received your RC210 slip or need a replacement, call the CRA at 1-800-959-8281 for assistance. They can provide a copy or guide you on how to access it.

Conclusion

The RC210 helps low-income Canadians get support through the Canada Workers Benefit. It shows the advance payments you received. Using it correctly when filing taxes helps you avoid mistakes like overpayments. Understanding the RC210 ensures you get the full benefit. Staying informed makes managing your taxes easier.