RC210 or Regular CWB ? Make Sure You’re Getting the Right Amount

Canada Workers Benefits provides financial support to help low-income individuals and families. However, there are two ways to access this benefit. One is through regular CWB payments at tax time and the other is advance payments reported on the RC210 slip. While both are part of the same program, they work differently. Here is the complete guide about Regular CWB payments and RC210 slip ( CWB Advanced payments).

Key Differences Between RC210 and Regular CWB

Here is the overview of the difference between CWB regular payments and RC210 form statements.

Feature | Regular CWB | RC210 (Advance Payments) |

|---|---|---|

Timing | Claimed once a year at tax time | Paid quarterly throughout the year |

How It’s Received | Added as part of your tax refund | Paid directly in advance installments |

Slip Involved | No specific slip required | Requires RC210 slip for reporting |

Reconciliation Needed? | No reconciliation; calculated based on final income | Reconciled with actual income at tax time |

Risk of Repayment | None | Possible if income exceeds eligibility limits |

This comparison highlights how RC210 advance payments differ from regular CWB.

What Is the Regular Canada Workers Benefit (CWB)?

The regular CWB is a refundable tax credit that you claim when filing your annual tax return. It’s designed to provide financial support to low-income and modest-income workers. The amount you receive depends upon various factors such as your income, marital status, and whether you qualify for additional benefits.

Example: Sarah is a single individual with a working income of $20,000 in 2025. The maximum Canada Workers Benefit (CWB) for singles is $1,518. Since Sarah’s income is below the phase-out threshold of $24,975, she qualifies for the full benefit.

At tax time, Sarah will receive $1,518 as a refundable tax credit to help support her finances.

Also Read Related Article Canada Workers Benefits ( CWB ) Enhancments 2025

Regular CWB Features

Here are the features that you can enjoy via regular CWB:

This option is ideal if you prefer receiving your benefit as a lump sum during tax season.

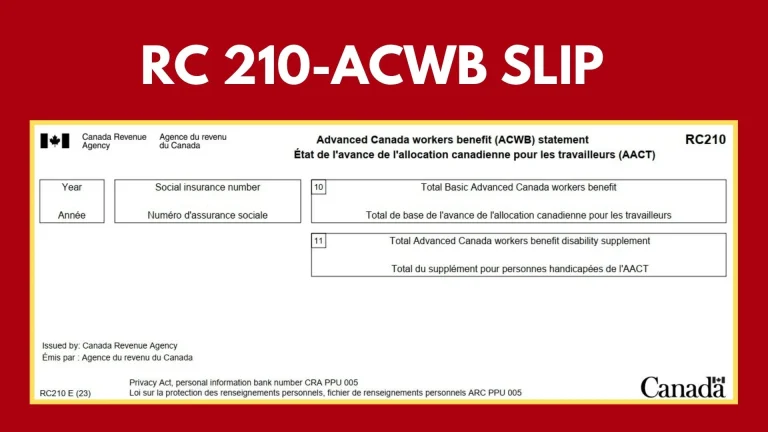

What Is the RC210 Slip?

The RC210 slip comes into play if you choose to receive advance payments of the CWB throughout the year. These quarterly payments provide financial support before tax season. The RC210 slip records how much your CWB was paid in advance and must be included when filing your taxes.

For Example:

At tax time:

This keeps everything balanced with the CRA.

Read Related Article RC210 ACWB Statement | Important Details for 2025 Payments

RC210 Advance Payments Features

The features of RC210 advance payments are given below:

This option is helpful if you need financial support throughout the year instead of waiting until tax time.

Read Related Article Filing Taxes with an RC210 Slip | 5 Common Mistakes to Avoid In 2025

Conclusion

The RC210 is an important tool for low-income Canadians to access financial support through the Canada Workers Benefit. Understanding how it works and using it correctly during tax filing helps you get the most out of the benefit while avoiding mistakes like overpayments. Staying informed about the RC210 can make managing your taxes easier and more effective.